estate tax changes build back better

Surtax of 5 on the modified adjusted gross income of a trust or estate above 200000 Additional 3 surtax on the modified adjusted gross income of a trust or estate. As a result the gift estate and GST tax exemptions are each 117 million per person in 2021.

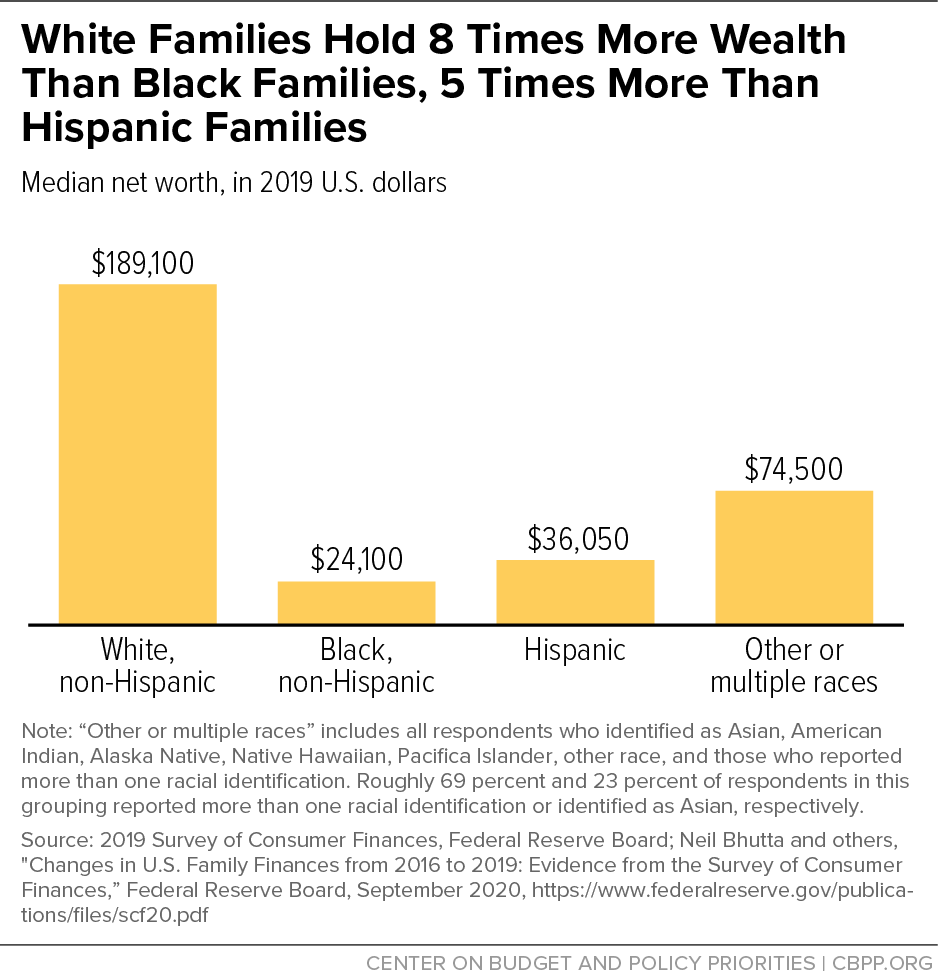

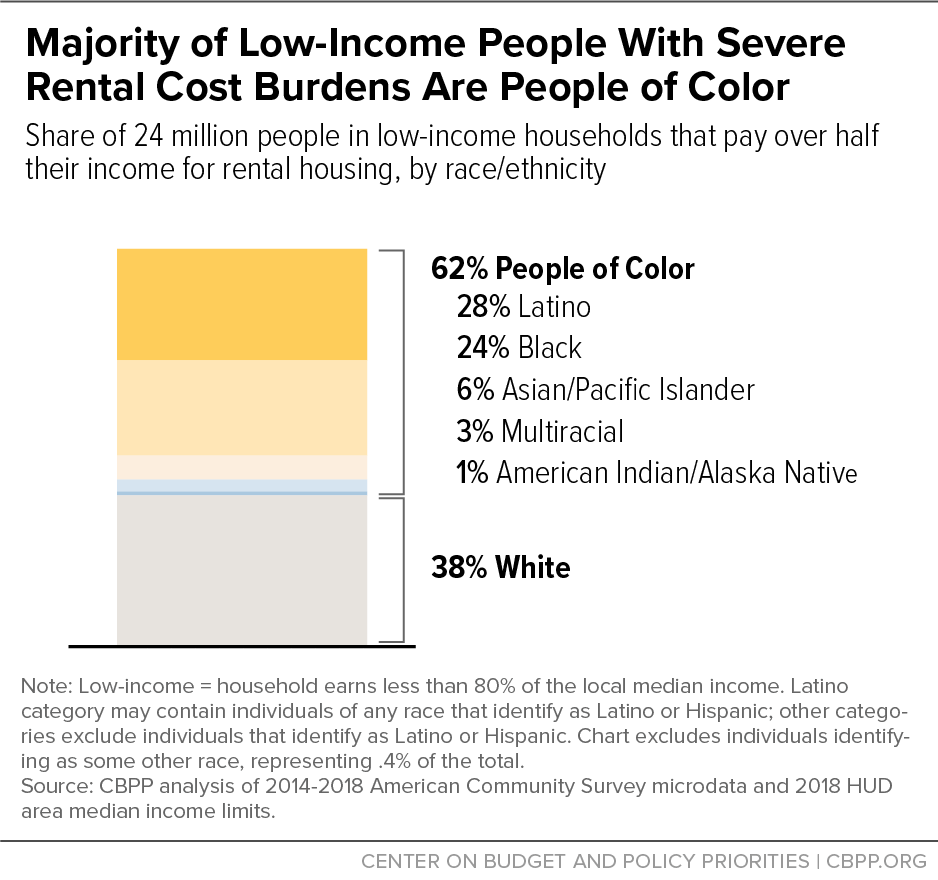

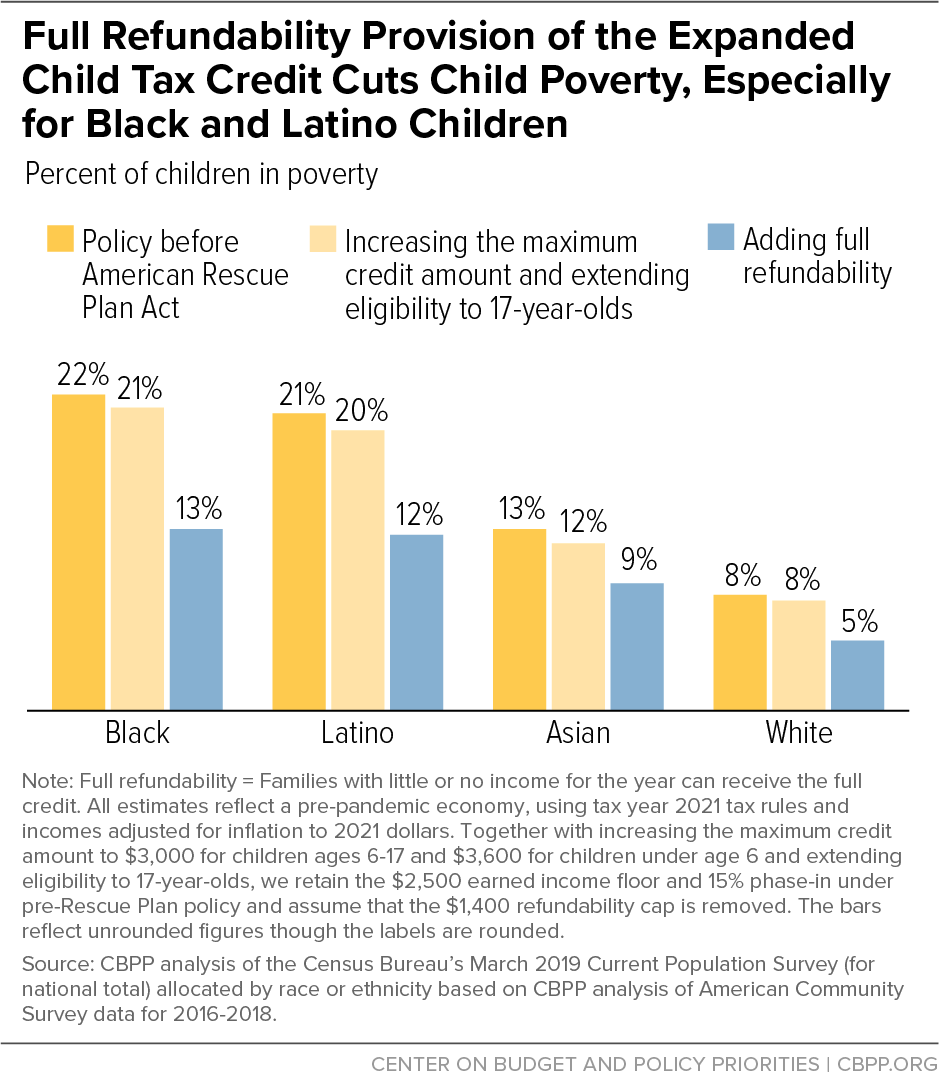

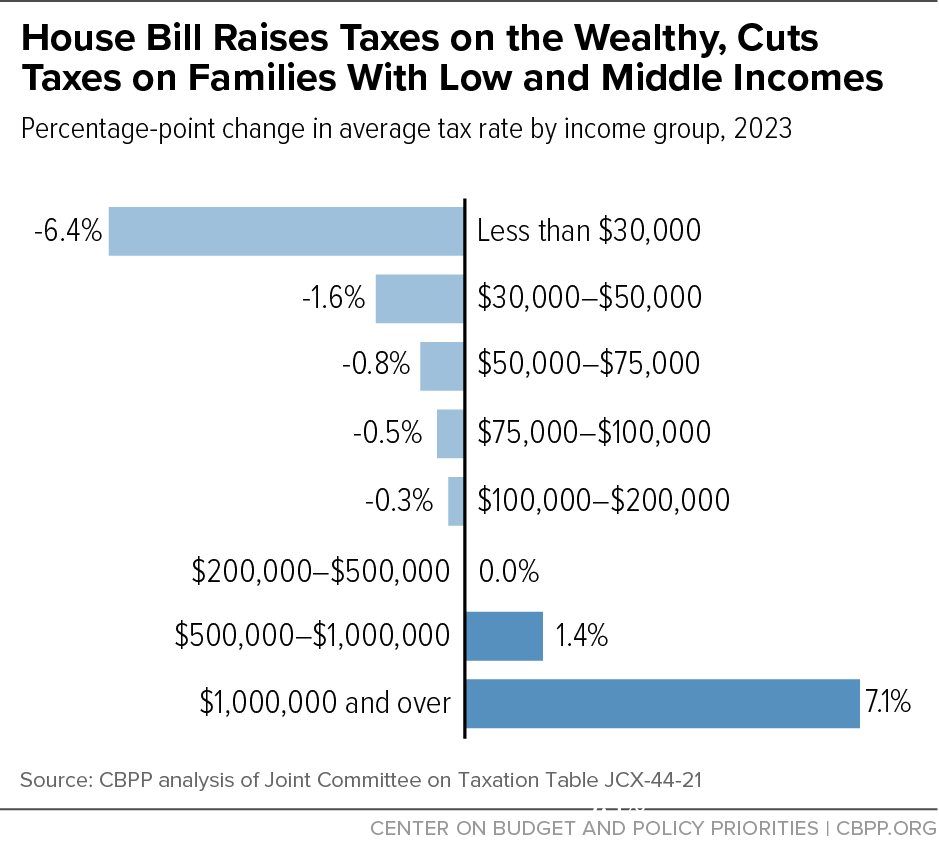

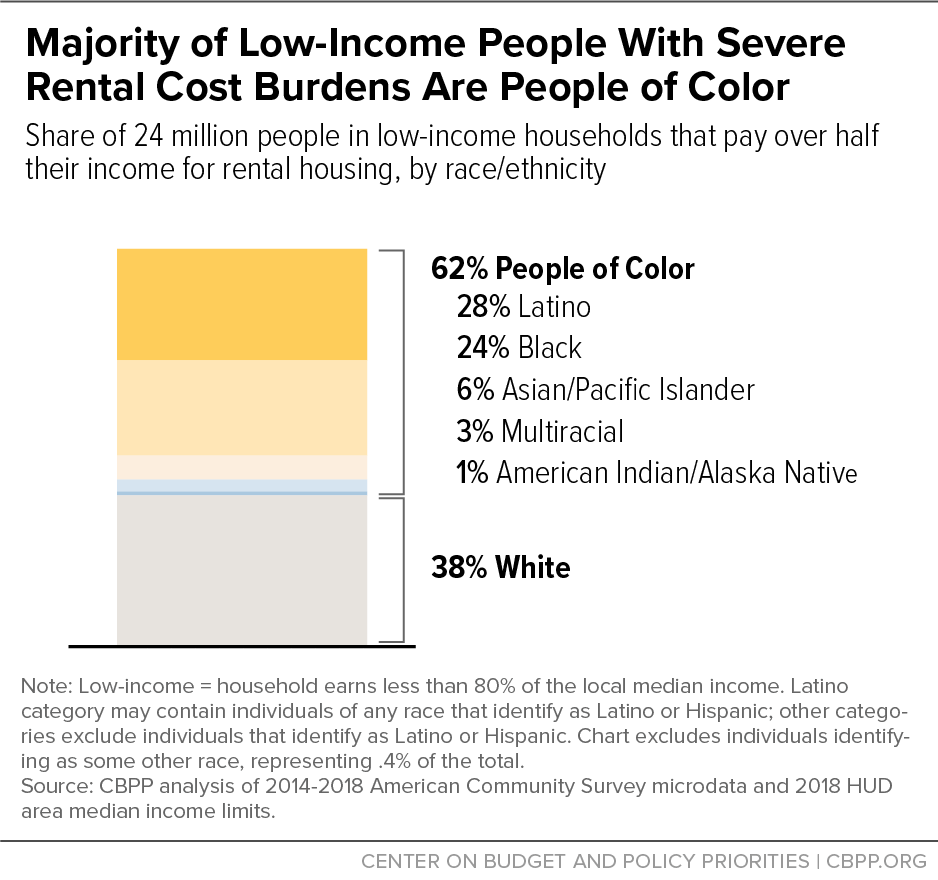

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Under the TCJA the exemption is scheduled to decrease to 5 million.

. Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been. On September 13 2021 the House Ways and Means Committee released a proposed tax bill. An affordable way to close out your loved ones affairs.

5376 that falls under his committees jurisdiction. Day Pitney Co-author s Stephen Ziobrowski Tasha K. By Taylor Lihn PLLC.

November 5 2021. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for. President Bidens proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan.

Build Back Better Act and Estate Planning Changes. Ad Settling a loved ones estate can be time consuming. Heres what you need to.

Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law. On December 11 Senate Finance Committee Chair Ron Wyden released an update to the section of the Build Back Better Act HR. On September 13 2021 the House Ways and Means Committee proposed sweeping and unprecedented changes to the.

The bill encompasses a wide range of budget. Significant Estate Gift and Income Tax Changes Proposed Under The Build Back Better Act. Gift and Estate Taxes Proposed Under the Build Back Better Act Lowering the gift and estate tax exemptions seems a lock.

Proposed Tax and Trust Changes in the Build Back Better Act. In its current form the legislative proposal. Were here to make it easier.

The prior version of the Build Back Better bill made substantial and far-reaching changes to the taxation of grantor trusts and transactions between the grantor and the trust. The BBBA proposal seeks to reduce these. December 3 2021.

5376 would revise the estate and gift tax and treatment of trusts. In approving its tax provisions the House Ways and Means Committee approved President Bidens Build Back Better Act BBBA. Two recent pieces of legislation the Infrastructure Investment and Jobs Act IIJA and the Build Back Better BBB bill were expected to include provisions changing the.

5376 the Build Back Better Act by a vote of 220213. These proposals are currently under. Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA.

The estate planning community got some very good news on October 28 2021. The House of Representatives on Friday morning passed HR. President Bidens Build Back Better Act BBBA has made a significant first step towards passage as the House.

The House Ways and Means Committee approved President Bidens. The Effects of the Build Back Better Act on Estate Planning.

Biden Budget Biden Tax Increases Details Analysis

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

More Than 12 Billion In Lihtc Provisions And Nearly 6 Billion For Neighborhood Homes Tax Credits In Nov 3 Draft Of The Build Back Better Reconciliation Bill Would Finance Close To 1

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Estate Tax Advisers Help Clients Pass On Generational Wealth Bloomberg

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

One Person Who Deserves Blame For Biden S Stalled Agenda Is Joe Biden The Washington Post

Lily Batchelder Lilybatch Twitter

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Biden Signs Major Climate Health Care And Tax Bill Into Law Roll Call

Business Capital Gains And Dividends Taxes Tax Foundation

Varo Mobile Checking No Fees Free Atms Get Paid Early Bank Account Personal Loans Savings Account

Biden Announces 2 Trillion Climate Plan The New York Times

Climate Bid Faces Tricky Path Over Money For Electric Cars Ap News

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation